The financial niche is one of the industries that’s hard to generate leads, and for several reasons.

For one, the competition is fierce, with everyone vying for customers’ attention. It becomes difficult to penetrate the market, especially if you’re new.

Also, it’s hard to gain customers’ trust.

Think about it. Will you give your hard-earned money to a company you know nothing about? I wouldn’t do that. I wouldn’t risk losing money or exposing confidential information to the public.

Another reason is that financial products and services require long-term commitments. Hence, even if your offer is better, customers will still be reluctant to switch providers or even make significant changes to their financial arrangements.

These challenges don’t mean a financial company can’t be successful.

In fact, many finance businesses are thriving lately.

And guess what’s behind their lead generation success…

You’re right. It’s digital marketing.

Digital marketing can solve most, if not all of your marketing woes. It can help you;

- Generate new leads and customers

- Build trust with your audience and potential clients, and

- Ultimately lead to sales and conversions.

That’s what this post is about.

We will dive into the ins and outs of digital marketing and how you can use its power for your finance business. Whether you’re a novice or an established businessman, this post will provide nuggets you can use now to see a massive improvement in your lead generation and sales.

This post will be a long one, so go through the subheads to read the parts that’ll be the most useful to you at the moment.

Let’s begin.

- What is Financial Digital Marketing?

- Advantages of Digital Marketing Over Traditional Marketing

- Know Your Target Audience

- Define Your Financial Digital Marketing Goals

- Work on Your Website

- Search Engine Optimization

- Content Marketing for Your Financial Services

- PPC Advertising

- Explore the Indefinite Opportunities with Finance Digital Marketing

What is Financial Digital Marketing?

Financial digital marketing is simply marketing online. It refers to using online and digital channels to promote financial products, services, and brands.

In short, whatever you do online for your financial business to drive awareness about your brand, find new customers, and engage with them is called digital marketing.

When you create a flyer and circulate it on social media to announce your services, you’ve done digital marketing.

If you have a Facebook page where you publish content and have a few followers, you’re also doing digital marketing.

Financial digital marketing has several aspects.

Search Engine Optimization has to do with structuring your website such that it shows up on top of search results.

Content marketing is where you share valuable, informative, and relevant content, such as blog posts, videos, infographics, ebooks, etc, to build trust and establish expertise.

And we also have social media marketing. I think the name is self-explanatory; marketing on social media in various ways.

There are other aspects of digital marketing. We’ll discuss them further in detail in this post.

We’ve already seen that digital marketing can help you get new leads, build trust with customers, and improve brand awareness.

But why do we prefer digital marketing over traditional marketing?

Advantages of Digital Marketing Over Traditional Marketing

Even though both digital and traditional marketing are great methods for promoting products or services, digital marketing is more effective than traditional marketing for these reasons;

Increased Online Presence

These days, consumers actively search for financial products and services online. It’s convenient and fast, and gives them several options for products to choose from.

Customers looking for financial services are doing the same thing.

Having a strong digital presence through website optimization, SEO, and social media marketing allows your financial company to be more visible to potential customers and increase brand awareness.

Targeted Marketing

We all know that the traditional methods of advertising, such as billboards, TV ads, and newspaper ads, are pretty ineffective in targeting specific audiences.

This untargeted approach can lead to a lot of wasted money on audiences who are not interested in what your business has to offer.

Digital marketing, on the other hand, makes things interesting.

It enables finance companies to target specific audience segments based on demographics, interests, behaviors, and online activities, ensuring that your marketing efforts reach the most relevant and potential leads, and increasing the chances of conversion.

Cost-Effectiveness

Compared to traditional marketing channels like print or TV ads, digital marketing offers a more cost-effective way to reach a larger audience.

It’s cheaper to run ads ($20 is enough to run ads that thousands will see) than put up billboards or buy space in newspapers.

You can allocate your marketing budget efficiently, spending on campaigns that generate the best return on investment (ROI).

Lead Generation and Customer Acquisition

Through digital marketing techniques such as lead magnets, email marketing, and content marketing, you can easily attract and capture leads effectively.

Unlike the monotonous traditional marketing techniques, digital channels provide various touchpoints to nurture leads through the sales funnel, increasing the chances of converting them into paying customers.

Moreover, it makes saving their contact information seamless.

The best part of digital marketing is that you can track everything you do, see which ones are working, and continue doing those. It’ll be hard to get that data from traditional marketing methods.

Improved Customer Engagement

Unlike traditional marketing, where communication is one way, digital marketing fosters two-way communication with customers, allowing finance companies to engage with their audience.

These engagements come in the form of email responses, social media interactions, comments on blog posts, and anything else you could think of.

And this kind of engagement is essential for your finance company because once customers feel engaged with you, it makes them trust your company and refer you to others.

Data-Driven Decision Making

With digital marketing, you can get valuable data and analytics that offer insights into customer behavior, preferences, and campaign performance.

This data helps finance companies refine marketing strategies and optimize their efforts for better results.

Brand Building and Reputation Management

Digital marketing enables finance companies to establish a consistent brand identity and voice across various channels.

Through content marketing, thought leadership, and social media interactions, companies can build a positive brand reputation and gain the trust of potential customers.

Personalization and Customization

Digital marketing allows finance companies to deliver personalized content and offers to individual customers based on their preferences and behaviors.

Personalized marketing creates a more tailored and relevant experience, increasing customer satisfaction and loyalty.

Global Reach

You can only put your billboards at specific locations, and only those in that area will see it. The same with radio and TV. You can only reach the local audience.

It’s not the same with digital marketing.

Digital marketing breaks down geographical barriers, allowing your message and ads to reach customers across different regions and even international markets.

This global reach opens up new growth opportunities and customer bases.

These are just a handful of all the goodies you get when you decide to switch to financial digital marketing.

By now, you’re eager to get started marketing online. But wait. Digital marketing has many possibilities, but it also has several pitfalls.

To truly succeed, you need to have a “roadmap.”

Question: how do you decide which route to use if you don’t know where you’re going?

Yes, we’re talking about goals.

Before you begin digital marketing, you must know who you want to reach and what you want them to do when you get them.

Know Your Target Audience

Knowing your audience is crucial in financial digital marketing because it allows you to tailor your strategies, messages, and offers to resonate with the specific needs and preferences of your potential customers.

When you understand your audience better, you can increase the effectiveness of your marketing efforts and achieve higher engagement, conversions, and customer satisfaction.

You can begin finding your customer’s information by analyzing data from your website, social media, and email marketing campaigns.

Tools like Google Analytics and social media insights provide valuable data on the demographics, behaviors, and interests of your website visitors and followers.

Surveys and feedback forms can also be used to gather direct insights from your existing customers.

When doing financial digital marketing, you should target individuals who match your ideal customer profile.

This includes people who are most likely to benefit from your financial products or services and align with your company’s values.

Factors to consider may include age, income level, financial goals, investment preferences, and risk tolerance.

Here are examples of people you can target for your finance business;

Young Professionals and Graduates: Financial companies may focus on young professionals and recent graduates who are in the early stages of their careers and need guidance on managing their finances, setting financial objectives, and accumulating wealth.

Families and Parents: Families and parents are often concerned about financial security, investments, and planning for their children’s education and future. You can offer products and services that address these specific needs.

Small Business Owners: these people require assistance with business financing, cash flow management, and retirement planning tailored to their entrepreneurial needs.

You can also target retirees and pre-retirees. For them, they are interested in financial solutions that provide a stable income stream and preserve their wealth during retirement. You can offer retirement planning and investment options suited to their specific stage of life.

Financial companies may target high-net-worth individuals who require specialized wealth management and estate planning services.

Real estate investors will also be interested in mortgage services, property financing, and guidance on property portfolios.

You see, there are many people you can target depending on who will be more interested in your services.

If you take the time to know who you’re selling to and craft messages that’ll appeal to them and address their pain points, and make you their hero.

Okay. You know who you’re trying to target. It’s time to set marketing goals.

Define Your Financial Digital Marketing Goals

Imagine your financial marketing goals as destinations on a map. Each destination represents a specific objective you want to achieve.

As you progress towards each goal, you’ll mark your milestones, much like landmarks along a journey.

Without these destinations, you might find yourself wandering in a marketing wilderness without a clear path or a sense of accomplishment.

Setting goals in financial digital marketing is like charting a course on a GPS navigation system.

It guides you step-by-step toward your desired destination – be it increased conversions, brand recognition, or improved engagement.

With each milestone achieved, you’ll gain insights to optimize your strategies and stay on the right track.

Without clear and well-defined goals, your financial digital marketing efforts can end up being like driving aimlessly without a specific direction.

It Gives You Direction

Setting goals helps you define a purposeful direction for your marketing efforts. It answers the question, “Where do we want to go?” For instance, your goal might be to increase brand awareness, generate leads, or drive online sales for a specific financial product.

It Helps You Measure Your Results

Goals act as yardsticks for measuring your progress and success. They allow you to track key performance indicators (KPIs) and assess how effective your strategies are. Imagine trying to determine how far you’ve come on your road trip without any milestones or signs – it would be challenging and confusing.

Helps Better Apportion Resources

Knowing your goals enables you to allocate your resources effectively. Whether it’s budget, time, or manpower, having clear objectives helps you invest your resources wisely in areas that align with your targets.

There are several goals you can set, all depending on what your company needs. Here are a few examples.

Examples of Goals for Financial Service Digital Marketing

Increase website traffic: Set a goal to increase the number of visitors to your website, as more traffic can potentially lead to more leads and conversions.

Lead generation: Aim to generate a specific number of leads per month through your marketing efforts. These leads can be potential customers interested in your financial services.

Improve conversion rate: Set a goal to enhance your website’s conversion rate, which means increasing the percentage of website visitors who take the desired action, such as filling out a contact form or subscribing to your newsletter.

Social media engagement: Establish a goal to increase engagement on your social media platforms, such as likes, comments, shares, and click-throughs.

Brand Awareness: Focus on increasing brand visibility and recognition among your target audience. This can be measured through metrics like social media mentions, press coverage, or brand searches.

When setting goals, always keep in mind that your goals should be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound.

This way, you’ll have a clear roadmap and be able to measure your progress effectively.

Having your goals in place, it’s time to see if your website is in the shape to help you attain your goals.

Work on Your Website

Your website is the online storefront or online face of your financial services company. Making your website not only appealing but also user-friendly is essential to attract and retain customers.

Let’s explore some key ingredients that’ll make your website a delightful place for clients to explore and engage with your financial services.

Need for Speed

Ever visited a website that took ages to load? Frustrating, right?

Well, your clients feel the same way.

Website speed is crucial for a positive user experience. Imagine your website as a high-speed train, whisking clients to their desired destination (financial solutions) swiftly and smoothly.

Having a fast-loading website is crucial for creating a positive first impression and showcasing your company’s dedication to efficiency and customer satisfaction.

It also helps to keep clients engaged and exploring your services, resulting in a lower bounce rate.

Search engines like Google take website speed into account when ranking search results, meaning a faster website can lead to higher visibility and improved SEO rankings.

Where’s Your Privacy Policy Page?

A privacy policy page is a statement that outlines how a company collects, uses, and protects the personal information of its customers.

This information can include things like names, addresses, phone numbers, and financial data.

For financial companies, a privacy policy is particularly important because they collect and store sensitive financial information from their customers.

This information needs to be protected and kept confidential to prevent identity theft, fraud, and other types of financial crimes.

A privacy policy page is a way for financial companies to communicate to their customers that they take privacy seriously and that they have measures in place to protect their personal information.

It’s also a legal requirement for most financial institutions to have a privacy policy in place and to make it easily accessible to their customers.

Think of your privacy policy as the vault where you keep your clients’ trust and data safe. Like a solid lock, a clear and comprehensive privacy policy instills confidence in your clients, assuring them that their sensitive information is handled with utmost care.

If you don’t have a privacy policy page yet, speak to your attorney to help you with it asap. It’ll surprise you the impact this simple tweak can boost your trust with customers.

Make Your Site Mobile Responsive

These days, it’s more than necessary for your website to be as friendly on smartphones and tablets as it is on desktops.

Think of mobile responsiveness as your ability to provide financial services to clients on the go, meeting them where they are, on their smartphones.

I guess we need not give you statistics on the number of people who use their phones to search for services.

You can use yourself as a living example. How often did you go to your desktop or laptop when you need an info quickly?

For me, I use my phone 95% of the time for searches, especially when I need a service.

Benefits of Mobile Responsiveness:

Here’s the bottom line;

Having a mobile-friendly website can help you reach a wider audience, improve user experience, and boost your search engine rankings since Google considers mobile-friendliness as a ranking factor.

After you’ve fixed these technical issues with your website, it’s time to optimize for search engines, also known as SEO.

Search Engine Optimization

SEO is the practice of optimizing your website and content to rank higher on search engine result pages (SERPs).

When potential clients search for financial services online, you want your website to appear prominently, right where they can easily find it.

That’s what SEO helps you achieve, making it a vital component of your digital marketing strategy.

Implementing SEO strategies can greatly benefit your financial business. When you appear higher in search results, your services will gain more exposure, increasing brand visibility.

SEO helps attract targeted traffic by drawing in users who are actively searching for financial solutions.

This makes them more likely to convert into leads or customers. Additionally, a higher search ranking in search results signals to search engines that your business is credible and trustworthy, which will enhance your reputation online.

And most importantly, organic search traffic generated through SEO is cost-effective since it’s free, reducing the need for expensive paid advertising.

Therefore, incorporating SEO into your business strategy is a smart investment that can yield significant returns.

Key Elements of SEO

Understand Your Clients’ Language

Keywords are the words or phrases people use when searching for financial services. Identify relevant keywords that align with your services and clients’ search intent.

For instance, “financial planning for retirement” or “investment advice for beginners.” These are keywords that your potential customers may type into search boxes when they need these services.

Use these keywords naturally throughout your website’s content, including titles, headings, and meta descriptions.

Optimize Your Website for Success

With the keywords you found, it’s time to put them into strategic places on your website. These places include:

Title Tags and Meta Descriptions: Craft compelling titles and descriptions for each page, incorporating relevant keywords.

URL Structure: Use descriptive and SEO-friendly URLs that clearly indicate the page’s content.

Header Tags: Organize your content with proper header tags (H1, H2, H3, etc.), making it easy for search engines to understand your page’s structure.

Image Optimization: Optimize images by using descriptive file names and alt tags, which help with accessibility and SEO.

Get Quality Backlinks

Backlinks are links from other websites pointing to yours. Search engines consider them as votes of confidence in your website’s credibility.

Instead of finding just any backlink, focus on obtaining high-quality backlinks from reputable sources, such as industry publications or financial blogs.

You can also use a guest-posting strategy, where you produce valuable content on other people’s websites. That way, they’ll link the post naturally to you.

Cater to Mobile Users

Many people are browsing on their mobile devices. That’s why having a mobile-friendly website is essential for SEO.

Making your website responsive ensures your site adapts to various screen sizes, providing a seamless experience for mobile users.

Another thing to consider is how easy your website is to use. Search engines prioritize user experience.

Ensure your website is easy to navigate, loads quickly, and provides valuable information.

A positive user experience encourages visitors to stay longer on your site, which can improve your search engine rankings.

Capture Nearby Clients with Local SEO

If you have physical locations for your financial services, local SEO is crucial. Your local customers are the low-hanging fruits when it comes to generating new leads for your business.

Claim and optimize your Google My Business listing, ensure consistent business information across directories and encourage client reviews.

SEO is not a one-time fix. It’s an ongoing process.

Search engines continually update their algorithms, and your competitors are also vying for top positions.

So if you want to stay on top of search engines for a long time, you need to work hard.

Thankfully, you don’t have to do it alone. Agencies like Flying V Group are all over the internet and familiarizing themselves with everything SEO.

They eat and breathe SEO and will go above and beyond to help you climb on top of search results and stay there.

Content Marketing for Your Financial Services

Content marketing is a powerful tool that can make a significant impact on your business growth.

Let’s break it down so you can fully understand its importance and how it can help your business.

What is Content Marketing?

Content marketing is all about creating and distributing valuable, relevant, and consistent content to attract and engage your target audience.

It goes beyond direct sales pitches and aims to build trust and credibility with potential customers.

Providing useful information and solutions to your customers can make you an expert in your industry.

This can help your brand become more well-known and build customer loyalty.

Engaging content can attract possible leads, enable you to obtain their contact information, and transform them into loyal customers.

It stimulates discussion and interaction, fostering a more profound connection with your audience and transforming them into brand advocates.

Moreover, when your content is shared and appreciated, it broadens your reach, elevating your brand’s visibility and recognition.

It’s an impressive strategy that can enhance your website’s visibility and facilitate the discovery of potential customers.

Types of Content for Your Business

When doing content marketing for your finance company, you can create all kinds of content for your customers;

Blog Posts: Share informative articles, industry insights, tips, and guides relevant to your target audience.

Infographics: Visual content that simplifies complex information, making it more engaging and shareable.

Videos: Engage your audience with explainer videos, interviews, or educational content. Video content is highly popular and can leave a lasting impact.

eBooks and Guides: Provide in-depth content packaged as downloadable resources to showcase your expertise.

Case Studies: Demonstrate your success stories and how your services have benefited your clients.

Podcasts: Consider starting a podcast to discuss industry trends and best practices, and interview industry experts.

Social Media Posts: Share bite-sized content, tips, and updates to keep your audience engaged across various platforms.

As you create content, it’s crucial to optimize your work for search engines by using relevant keywords and meta tags.

But don’t stop there.

Actively promoting your content on social media, newsletters, and other platforms will increase visibility and drive traffic.

In creating content, keep in mind that quality content is key.

Focus on creating valuable pieces rather than churning out mediocre ones. And don’t forget to engage with your audience by responding to comments and messages promptly.

By fostering a sense of community, you’ll create a loyal following that will keep coming back for more.

Content marketing takes time to yield results, but with dedication and a well-executed strategy, it can be a game-changer for your finance business.

If you need any assistance in implementing a content marketing plan, feel free to reach out.

PPC Advertising

Pay-Per-Click (PPC) is a crucial component of digital marketing for financial businesses. It’s a highly effective advertising method that allows you to target potential customers directly while paying only when they click on your ads.

Let’s dive into the world of PPC for financial digital marketing:

What is PPC?

PPC, as the name suggests, is a form of online advertising where advertisers (in this case, your financial business) pay a fee each time one of their ads is clicked.

These ads are displayed on search engines like Google or Bing, as well as on various websites and social media platforms.

The goal is to drive traffic to your website or landing page, increase conversions, and, ultimately, achieve your business objectives.

Why Use PPC for Financial Digital Marketing?

Using PPC (Pay-Per-Click) for financial digital marketing offers several compelling advantages for businesses in the financial industry:

Immediate Visibility: PPC allows your financial business to appear at the top of search engine results pages and on relevant websites and social media platforms instantly. This means potential customers can find your services right when they are actively searching for financial solutions.

Precise Targeting: With PPC, you can target your ads based on specific keywords, demographics, locations, devices, and even the time of day. This level of targeting ensures your ads reach the right audience, maximizing the chances of attracting qualified leads.

Cost Control: You have complete control over your PPC budget, setting daily or monthly caps to manage your spending effectively. This flexibility ensures you only pay for the clicks received, making it a cost-efficient advertising method.

Measurable Results: PPC platforms provide detailed analytics and performance metrics, allowing you to measure the success of your campaigns. You can track clicks, impressions, conversions, and the return on investment (ROI) for each ad, enabling data-driven decision-making.

Complementing SEO Efforts: While SEO (Search Engine Optimization) is essential for long-term organic growth, it takes time to see significant results. PPC can complement your SEO efforts by providing immediate traffic and visibility while your website continues to climb the search engine rankings.

Geo-Targeting: For financial businesses operating in specific regions or locations, PPC offers advanced geo-targeting options. You can target users based on their geographical location, ensuring your ads reach the most relevant audience for your services.

Brand Awareness: Even if users don’t click on your PPC ads, they still see your brand and message. This exposure helps build brand awareness and keeps your financial business top-of-mind for potential customers when they are ready to make financial decisions.

Quick Testing and Optimization: PPC campaigns are highly flexible, allowing you to quickly test different ad copy, keywords, and landing pages. You can analyze the performance data and optimize your campaigns in real time, making improvements that lead to better results.

Ad Extensions: PPC platforms offer ad extensions and additional elements that enhance your ads, such as call buttons, site links, location information, and more. These extensions provide more information to users and increase the visibility and credibility of your ads.

PPC is a valuable tool that, when used effectively, can make your financial business reach the right audience, increase brand awareness, and drive qualified leads, ultimately contributing to business growth and success.

PPC Platforms You Can Use for Finance

PPC platforms are online advertising networks that allow you to create and display your ads.

These platforms allow you to bid on keywords or target specific demographics to show their ads to potential customers.

As we’ve mentioned already, you only pay when someone clicks on their ads, which makes PPC an effective and cost-efficient advertising method. Here are a few examples:

Google Ads (formerly Google AdWords)

As the most widely used PPC platform, Google Ads allows a to display ads on Google’s search engine, partner websites, and various Google services like YouTube and Gmail.

It offers a wide range of targeting options, including keywords, demographics, locations, and interests.

Bing Ads

Bing Ads is Microsoft’s PPC advertising platform, similar to Google Ads. It displays ads on the Bing search engine and its partner sites, including Yahoo.

While its reach is smaller than Google, it can still be valuable for reaching specific audiences.

Facebook Ads

With a vast user base, Facebook Ads is a powerful platform for targeting specific demographics, interests, behaviors, and custom audiences.

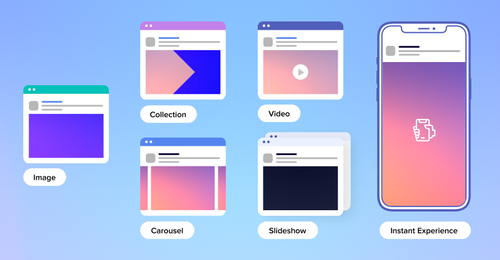

You can create images, videos, carousels, and many more to engage users on Facebook, Instagram, Messenger, and Audience Network.

LinkedIn Ads

LinkedIn is a professional networking platform, making it ideal for B2B advertising. LinkedIn Ads allow precise targeting based on job titles, industries, company sizes, and other professional attributes.

Twitter Ads

Twitter Ads help advertisers promote tweets, accounts, or trends to a targeted audience. It allows targeting based on interests, demographics, and keywords relevant to users’ tweets.

For all the PPC ad types we’ve mentioned, certain features are common to all of them. And you need to familiarize yourself with them to help you succeed when running PPC ads.

Key Features of PPC Platforms

PPC ad platforms offer powerful tools to effectively target your audience, control costs, and measure performance, making them essential for successful digital advertising campaigns.

Keyword Bidding: Advertisers bid on relevant keywords, and their ads appear when users search for those keywords or related terms. The highest bidder typically gets the top position.

Different ad Formats: PPC platforms offer various ad formats, including text ads, image ads, video ads, carousel ads, and more, catering to different marketing objectives and creative needs.

Targeting Options: Advanced targeting capabilities allow advertisers to reach their ideal audience based on keywords, demographics, interests, behaviors, and even website retargeting.

Budget Control: You can set daily or monthly budgets to control your ad spend and avoid overspending.

Ad Auctions: When a user searches for a keyword or visits a website displaying ads, an ad auction determines which ads will be shown. The ad’s relevance, bid amount, and other factors influence the ad’s position in the auction.

Quality Score: PPC platforms often use a quality score to evaluate the relevance and quality of ads and landing pages. A higher quality score can lead to lower costs and better ad positions.

Ad Performance Metrics: PPC platforms provide comprehensive analytics to track ad performance, including click-through rates (CTR), conversions, conversion rates, cost-per-click (CPC), return on ad spend (ROAS), and more.

Explore the Indefinite Opportunities with Finance Digital Marketing

The power of digital marketing cannot be ignored, especially in the finance sector.

When you leverage the immerse immense opportunities it offers, your financial firm can connect with your target audience more effectively, build brand authority, and achieve remarkable business growth.

So, take the leap into the world of digital marketing, and witness your finance business flourish like never before.

Define your goals, strategize your approach, and consistently deliver value to your target audience.

With dedication and creativity, you’ll see your financial brand soar to new heights in the digital realm.

I know. You can’t do all these alone, especially when you’re already dedicated to running your business.

That’s why Flying V Group was born.

We do everything digital marketing. Most of all, we’ve worked with several clients in the finance industry. So we know all the ins and outs of how things work in finance.

When we do your finance digital marketing, rest assured that you’ll see impressive results within the first few weeks.

Don’t believe me? Find out for yourself!

0 Comments