Financial firms, despite their conservative nature, are no exception when we’re talking about having a robust online presence.

Social Media Marketing (SMM) has become a potent tool to engage clients, showcase expertise, and build brand recognition.

However, merely having a presence on social media platforms is not enough. You need to have a social media communication strategy.

To truly succeed, financial firms need to implement a well-crafted SMM strategy that aligns with their business objectives and target audience.

But strict regulations, privacy concerns, and the complex nature of financial vocabulary make it really challenging to navigate the social media landscape.

This article aims to guide financial firms on how to improve their social communication strategy to drive meaningful results while adhering to industry-specific constraints.

When you follow these essential tips below, your firm can enhance its online visibility, foster meaningful connections with clients, and ultimately generate a competitive edge in the digital landscape.

Set Clear Objectives

Before diving into any social media efforts, it is crucial to establish clear and measurable objectives. Identify what your financial firm aims to achieve through social media marketing efforts.

These kinds of goals and objectives will guide your path, because social media for enterprise can be complicated and confusing. These goals will serve as your ‘blueprints’ to navigate your way and ensure your success on social media.

Some common objectives could include:

Brand awareness: with this goal, you seek to Increase your firm’s visibility on social media platforms to reach a broader audience and build brand recognition.

Driving website traffic: do you want to use social media to direct potential clients to your website or landing pages?

Lead generation: maybe you want to attract potential clients through social media channels, converting them into leads, and ultimately acquiring new clients.

Thought leadership: you can also aim to demonstrate your expertise in the financial industry by sharing valuable insights and content.

Customer engagement: Building relationships and trust by interacting with clients and addressing their queries promptly.

Regardless of what goal you have, doing social media for enterprise will help you achieve them. But before any social media communication strategy will succeed, you need to know who you’re trying to target.

Identify Your Target Audience

In the financial industry, the audience might vary based on services offered, such as retail customers, high-net-worth individuals, and businesses.

To know exactly the kind of customers you want to reach, you need to conduct market research to gain insights into the preferences, needs, and pain points of your potential clients.

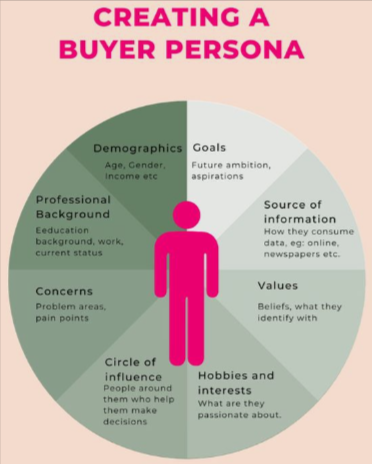

The most effective way to know your audience is to create buyer personas representing different segments of your target audience, including their demographics, interests, and online behavior.

By knowing your audience, you can tailor your content and social media communication strategy to resonate with them effectively.

Select Appropriate Social Media Platforms

Not all social media platforms are suitable for financial firms. That’s why you should identify which platforms align best with your target audience and objectives.

LinkedIn, for example, is particularly ideal for B2B interactions, thought leadership, and professional networking.

Meanwhile, Facebook and Twitter can be more effective for B2C engagement and brand awareness.

On the other hand, YouTube is valuable for hosting webinars, tutorials, and educational content.

Instagram and TikTok could also be explored for creative visual content and engaging younger audiences.

Always remember that it’s better to excel on a few platforms rather than spread your resources thin across all social media channels as not all social media platforms may be appropriate for all financial firms.

Create High-Quality Content

No matter what industry you choose, quality content is still king. When we say quality content, we mean content that’s relevant, useful, and solves a specific problem or answers a question for your audience.

That’s why the foundation of any successful social media communication strategy is valuable and relevant content.

In the financial industry, trust and credibility are paramount.

To build and maintain trust with your audience, focus on creating high-quality, informative, and relevant content.

You can develop various types of content, such as educational articles and blog posts to provide insights into financial trends, investment strategies, or tax planning tips, creating explainer videos, client testimonials, or Q&A sessions.

Additionally, complex financial concepts can be simplified into visually appealing graphics, as well as hosting webinars and live events to showcase expertise and improve client interaction.

Instead of publishing overly promotional content, provide content that’s valuable to your audience, positioning your financial firm as a reliable source of information.

Remember, content that adds value to the lives of your audience will set your brand apart and help establish you as an expert.

Consistency and Frequency

Consistency is key to maintaining a strong social media communication strategy.

Create a content calendar that outlines the type of content to be posted, the frequency of posts, and the platforms on which they will be published.

Posting at regular intervals keeps your audience engaged and prevents your brand from fading into obscurity.

Yet, avoid overwhelming your followers with excessive content, as it may lead to disengagement.

You should also maintain consistency in your brand’s tone, voice, and visual elements across all platforms.

A cohesive brand image fosters recognition and reinforces your firm’s identity. A well-structured content calendar ensures that your social media efforts are organized, relevant, and aligned with your business goals.

Engage and Interact

Social media for enterprise is a two-way communication channel. Engaging with your audience fosters a sense of community and builds trust.

To build a personal connection with your clients, it’s important to stay engaged by responding promptly to comments, messages, and mentions.

This not only adds a human touch to your financial firm, but also demonstrates your appreciation for your clients’ input and perspectives.

Acknowledge feedback, both positive and negative, and take the opportunity to address any issues publicly, if appropriate.

Should negative feedback arise, handle it professionally and promptly, turning it into an opportunity to showcase your excellent customer service.

Also, you can encourage conversations through polls, quizzes, or asking questions in your posts.

Utilize Paid Advertising in Your Social Media Communication Strategy

While organic reach is essential, consider investing in paid social media advertising to amplify the presence of your firm.

Paid ads enable businesses to reach new potential clients and boost lead-generation efforts.

Social media platforms like Facebook, LinkedIn, and Twitter offer robust advertising tools to target specific demographics, interests, and behaviors.

However, ensure your ads are relevant and alighs with your brand messaging and goals. Writing ads that convert is not that easy. You need an expert to do that for you.

You can hire an ads agency to do your ads for you. Flying V Group is a prime example. They’ve run lots of ads for various finance firms, delivering massive results. They’ll do the same for you.

Measure and Analyze Performance

To continuously improve your social media communication strategy, it’s crucial to track and analyze its performance.

Social media analytics tools provide valuable insights into key metrics, such as reach, engagement, click-through rates, and conversion rates.

Regularly review the data to identify what content and strategies resonate best with your audience and adjust your approach accordingly.

Humanize Your Brand

Let’s be honest. Financial services are perceived as intimidating or impersonal. It’s one of the most boring industries to think of. Who wants to read stuff about insurance and investments?

To overcome this barrier, you can add the human side of your brand to your post. Showcase the people behind your firm.

Introduce key team members through posts, videos, or behind-the-scenes content.

Highlighting your team’s expertise and commitment helps establish a personal connection with your audience, making your brand more approachable and trustworthy.

Consider using authentic photos of your team and workplace to add a human touch to your brand.

You can also tell all kinds of customer stories on your social media. These will engage people more than the straight-faced uptight messages that’re peculiar to finance.

Conclusion

A well-crafted social media communication strategy is a powerful tool that can elevate the online presence of your financial firm and foster meaningful relationships with clients.

By defining clear objectives, understanding your target audience, choosing the right platforms, creating quality content, maintaining consistency and frequency, engaging with your audience, utilizing paid advertising, analyzing performance, and humanizing your brand, your firm can take significant strides in improving its SMM strategy.

Stay adaptive to the dynamic digital landscape, and remember that building a successful social media presence takes time and consistent effort, so be patient and persistent in your approach.

With an effective SMM strategy in place, your financial firm can thrive in the ever-evolving digital space and achieve lasting success.

0 Comments