The financial services industry is becoming increasingly reliant on social media platforms to connect, engage, and transact with customers.

Business-client interaction is evolving as technology advances.

Social media platforms provide a convenient and efficient way for customers to access information, make transactions, and receive tailored advice.

We’ll explore the key social media platforms that are shaping the future of financial services and how businesses can leverage these platforms to enhance their customer experience.

The Role of Social Media in the Financial Services Industry

Social media platforms has changed how businesses communicate and engage with their customers. In the finance industry, social media provides convenience, accessibility, and personalized interactions for clients.

Some key roles that social media platforms play in shaping the future of financial services are as follows:

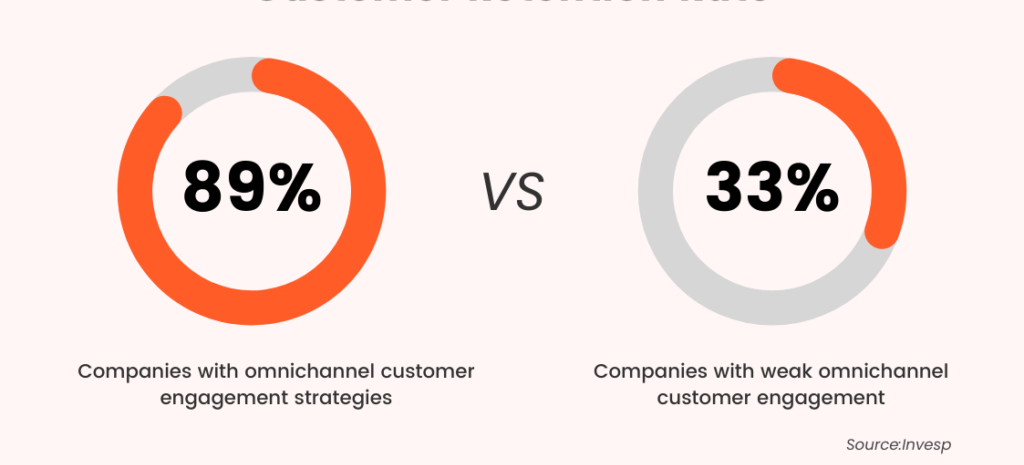

Customer Engagement

Social media platforms provide a direct channel for financial service providers to engage with their customers.

Through platforms like Facebook, Twitter, and LinkedIn, you can share industry news, promotions, and updates, as well as respond to customer queries and feedback.

This real-time interaction helps build a sense of trust, transparency, and accessibility, enhancing the overall customer experience.

Information Dissemination

Financial services rely on timely and accurate information, and social media is the right vehicle for broadcasting such information. It is a quick and effective way to distribute this information to your audience. Whether it’s news about new financial products, changes in regulations, or market insights, social media platforms enable businesses to reach a wider audience and keep their customers informed.

Personalization and Targeted Marketing

Social media platforms collect so much user data. This data allows businesses like yours to dive deep into your customers’ needs and pain points, know what interests them, and craft content that’ll be more suitable to your audience. It also helps when you’re targeting audiences for your paid ads.

When you analyze user behavior, demographics, and preferences, you can tailor your messaging to specific customer segments, increasing the relevance and effectiveness of their marketing efforts.

Financial Education and Awareness

Which better way to educate and build brand awareness than using social media platforms, the channel where you can find almost everybody?

You can share informative content, tips, and resources on topics such as budgeting, investing, and retirement planning, helping customers make informed financial decisions.

Social media also enables the sharing of success stories, testimonials, and case studies, inspiring and motivating individuals to take control of their financial futures.

Customer Support

Social media platforms provide a convenient and efficient avenue for customers to seek support or resolve issues.

Instead of waiting on hold or sending emails, customers can reach out to you through social media messaging or chatbots, receiving quick responses and solutions.

This ensures a higher level of customer satisfaction and reduces response times.

The Top Social Media Platforms for Financial Services in 2024

Facebook has emerged as one of the most versatile social media platforms, with immense potential for the financial services industry.

Its extensive user base, advanced targeting capabilities, and engaging features make it an ideal choice for financial service providers to connect with their target audience and achieve their business objectives.

By creating compelling content and utilizing Facebook’s advertising tools, you can effectively showcase your products, services, and expertise to a wide and diverse audience.

Additionally, you can use Facebook Live to host interactive sessions, webinars, or Q&A sessions, fostering a sense of community and building trust among their audience.

With Facebook, you can stay ahead in an increasingly competitive industry and create meaningful connections with your customers.

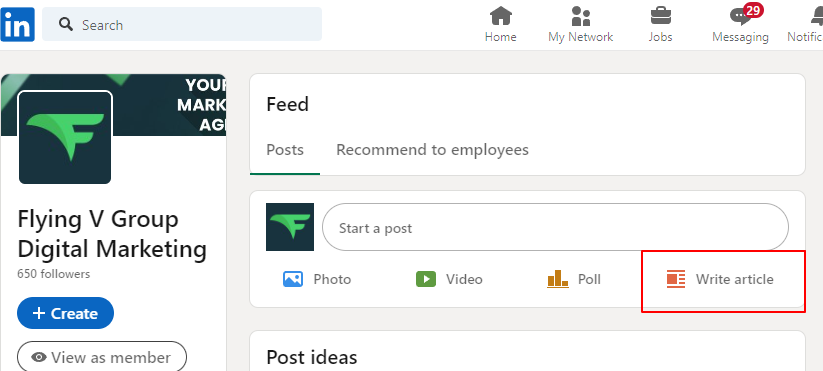

LinkedIn is a powerful social media platform specifically catering to professionals across various industries. It’s just like Facebook, except that everyone on LinkedIn is mentally prepared to do business. You could say Facebook for business.

For the financial services sector, LinkedIn offers unique opportunities to connect with industry peers, showcase expertise, and establish strong professional networks.

Through its publishing feature, you can publish articles and blog posts addressing industry trends and market insights to showcase your expertise and attract a wider audience of industry professionals who are seeking valuable and reliable information.

Financial services marketing providers can create dedicated company pages on LinkedIn to provide potential clients or partners with relevant information about the business, its services, and its unique value proposition.

Furthermore, LinkedIn’s Sales Navigator tool enables you to identify and connect with potential leads, nurture relationships, and explore new business opportunities.

When you use targeted advertising options, you can reach your desired audience based on specific criteria, such as industry, job title, or company size.

You can also share job openings and actively engage with potential candidates to establish themselves as desirable employers and attract high-quality individuals.

LinkedIn offers financial service providers a valuable platform to connect with professionals, establish thought leadership, generate leads, attract top talent, and stay updated on industry trends.

Businesses can enhance their professional presence, expand their network, and foster meaningful connections with industry peers and potential clients.

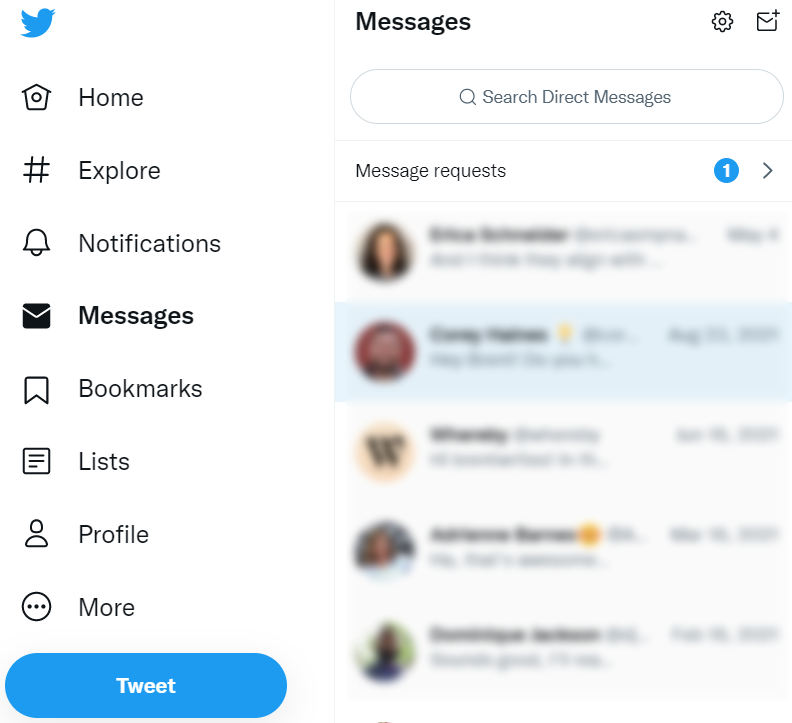

Twitter is a popular social media platform known for its real-time updates and quick interactions. Its fast-paced nature makes it an ideal platform to share real-time updates on market trends, financial news, and economic developments.

As a financial service provider, you can use Twitter to share breaking news, industry insights, and analysis, allowing them to establish themselves as a reliable source of information.

Twitter also provides a direct channel for you to engage with your customers and address their queries and concerns.

You can leverage features such as hashtags and retweets to extend the reach of your content and increase visibility.

This platform allows financial service providers to network with other businesses in the industry, influencers, and potential partners.

Collaborating with influencers through partnerships, guest blogging, or hosting Twitter chats can also help businesses reach new audiences and enhance brand credibility.

On this platform, businesses can enhance their online presence, strengthen customer relationships, and position themselves as industry leaders.

Instagram is a popular social media platform known for emphasizing visual content. While it may seem more suited to industries such as fashion, travel, or lifestyle, financial service providers can also effectively utilize Instagram to engage with their audience and tell their brand story in a visually appealing way.

Although Instagram may not be the first platform that comes to mind for financial service providers, it offers unique opportunities for visual storytelling, educational content, customer testimonials, influencer partnerships, community engagement, and brand promotion.

You can communicate your unique brand identity and create a visual narrative that resonates with your target audience.

Instagram’s visual format is also suitable for sharing educational finance-related content.

Financial service providers can also collaborate with influencers or industry experts to promote their brands on Instagram.

Like other platforms, you can use hashtags and contests to increase brand visibility and attract new followers, especially when your contests are interesting and engaging.

Let’s face it. Finance is a boring industry, just as health is not that appealing.

However, with creativity, you can use Instagram to engage with your audience on a personal level, build connections, and eventually build a strong online presence.

YouTube

YouTube is another powerful social media platform that allows financial service providers to share educational content with their audience, this time in video format.

YouTube provides a unique opportunity for financial brands to demonstrate their expertise, educate their audience, and establish themselves as thought leaders in the industry.

The platform has a live-streaming feature that helps you conduct webinars and live presentations.

With Youtube, you can also create tutorials, and invite industry experts and thought leaders for interviews and discussions to improve customer engagement.

These days, attention spans are limited. Video content has been found to hold people’s attention longer than text ever would.

When you leverage the power of video, financial brands like yours can establish themselves as trusted experts, engage with their audience on a deeper level, and build an excellent online authority within the financial industry.

TikTok

TikTok is a rapidly growing social media platform known for its short-form videos and is popular among younger audiences (Gen Z and Millennials).

Even so, your financial brand can use it to share informative and entertaining content in a format that resonates with younger viewers.

You can use various features and trends on TikTok to effectively communicate important financial concepts and tips in a way that resonates with this demographic.

TikTok is an interactive platform, and you can use challenges, quizzes, and collaborations with influencers to create a sense of community and encourage viewers to engage with your content.

Conclusion

The future of the financial services industry is heavily intertwined with the power of social media platforms. Facebook, LinkedIn, Twitter, Instagram, YouTube, and TikTok are transforming the financial services industry by providing opportunities for customer engagement, information dissemination, personalization, customer support, collaboration, and financial education. You must embrace these platforms, especially if you want to enhance your customer experience, stay competitive, and drive growth in the future.

Flying V Group is an all-round marketing agency. Why not speak to us for free so we show you all the creative ways you can use social media for your business?

Kindly drop your questions in the comments, and we’ll answer them as much as we can.

Source: Paved

Source: Paved

0 Comments