As a financial services professional, managing your social media compliance can be quite the balancing act. It’s crucial for you to ensure that your posts and interactions adhere to industry regulations, safeguarding both your reputation and your clients’ trust. This involves being vigilant about the content you share, the promotions you run, and the privacy standards you uphold.

By staying informed and proactive, you can turn social media from a compliance headache into a powerful tool for engaging with your audience effectively and ethically. Let’s explore how you can master social media compliance without missing a beat.

- Regulatory Framework

- Risks and Challenges

- Best Practices for Compliance

- Implementing Compliance Mechanisms

- Future Outlook

- Safeguarding Your Digital Presence

- FAQs

- What Are the Primary Regulations Governing Social Media Use in Financial Services?

- How Can Financial Institutions Monitor Employees’ Social Media Activity for Compliance?

- What Are the Consequences of Failing to Comply With Social Media Regulations?

- How Often Should a Financial Services Firm Update Its Social Media Compliance Policy?

- What Role Does Technology Play in Ensuring Compliance With Social Media Policies?

Regulatory Framework

In the dynamic landscape of financial services, ensuring your social media compliance is crucial, particularly when considering the impact of regulations like those from the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). These bodies have laid down strict guidelines to govern the use of social media, aiming to maintain transparency and prevent misinformation.

As your business embraces global markets, it’s vital to recognize the variations in compliance requirements across different countries. Each region may have its unique set of rules affecting how financial services can be promoted and managed through social media. Understanding these differences is key to crafting a strategy that is not only effective but also compliant with international standards.

If you’re looking to navigate these complex waters with ease, consider partnering with a team that thrives on challenges and excels in performance marketing. Our team, comprised of talented and dedicated individuals from across the globe, operates around the clock, ensuring that we are always available to support you. We are committed to bolstering your digital journey, ready to take turns at the helm and cheer you on every step of the way.

Our process begins with a thorough understanding of your business, moving on to tailor a unique digital strategy that includes social media marketing. This strategy is not just implemented but also continuously monitored and optimized to ensure it meets your evolving needs and goals.

By choosing to work with us, you are not just hiring a service provider; you are joining forces with a global team that believes in the power of unity and shared success. We aim to travel 70% further together, achieving goals that once seemed unreachable. Let’s join hands and make your digital presence formidable. Together, we can turn the challenges of social media compliance into opportunities for growth and success.

Risks and Challenges

When addressing social media compliance for financial services, it’s crucial to be mindful of the risks and challenges associated with managing online interactions. Let’s look into these aspects to ensure you’re well-prepared.

Potential Risks of Non-Compliance

- Financial Penalties: If your social media activities fall short of regulatory standards, you could face hefty fines. These are not just a drain on resources but also a public relations issue that can tarnish your brand’s reputation.

- Loss of Consumer Trust: Failing to comply can lead to breaches of customer data or misinformation, eroding trust and loyalty among your client base.

- Legal Consequences: Non-compliance could lead to lawsuits or legal disputes, adding legal fees and potential settlements to your list of worries.

- Operational Disruption: Dealing with the fallout from non-compliance issues can divert focus from your core operations, affecting service quality and efficiency.

Challenges in Managing Social Media Interactions

- Keeping Up with Regulations: The rules governing social media in the financial sector are constantly evolving. Staying informed and adapting your strategies accordingly can be daunting.

- Training and Awareness: Ensuring that all your employees are up-to-date on social media policies requires ongoing training and resources.

- Monitoring and Enforcement: Constant vigilance is needed to monitor social media activities. Implementing robust compliance tools and protocols can be resource-intensive but is crucial for risk mitigation.

- Balancing Engagement and Compliance: You want to engage effectively with your audience on social media while adhering to strict guidelines, which can limit how responsive and interactive your brand can be.

Ensuring compliance in your social media operations is not just about avoiding risks; it’s about safeguarding your reputation and maintaining the trust of your clients. By acknowledging these challenges and preparing accordingly, you can turn potential hurdles into stepping stones for success in the digital landscape.

Best Practices for Compliance

In the dynamic landscape of financial services, mastering social media compliance is crucial. Here are some best practices to keep your organization in line:

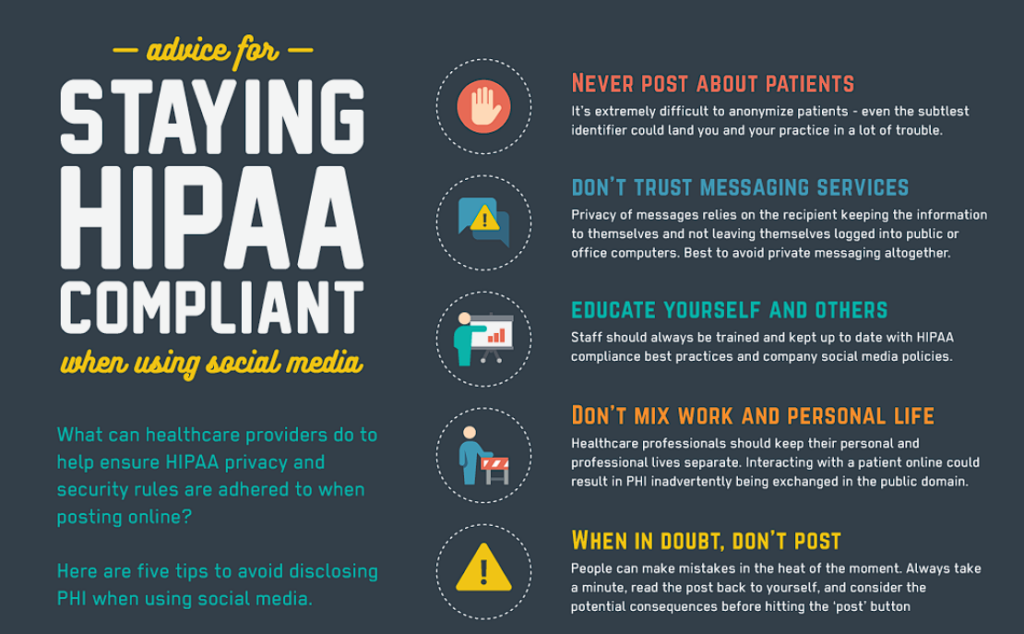

- Establishing a Social Media Policy: Crafting a robust social media policy is the first step to ensuring compliance. You should clearly define what is acceptable and what is not, detailing the type of content that can be shared and the conversations that employees can engage in. This policy should be regularly updated to keep pace with evolving regulations and social media features.

- Training and Education for Employees: You must educate your employees about the importance of social media compliance. Regular training sessions should be conducted to refresh their knowledge and inform them of any updates to your social media policy. This ensures everyone understands their responsibilities and the consequences of non-compliance.

- Tools and Technologies to Monitor Compliance: Leveraging the right tools and technologies can help you monitor and enforce compliance effectively. These tools can track posts and interactions across various social media platforms to ensure they adhere to your organization’s guidelines and regulatory standards.

Social media compliance doesn’t have to be daunting. By setting clear policies, educating your team, and using the right tools, you can navigate these waters smoothly.

As part of a company that operates with a global and dedicated team, we are equipped to offer you the best in performance marketing services. Our team is always on, always vigilant, ensuring that your digital marketing strategies not only meet the mark but soar beyond it. Let us join you in your digital journey, leveraging our unified strengths to achieve and even surpass your goals. Remember, together, we can go 70% further—let’s make it happen.

Implementing Compliance Mechanisms

After defining the compliance standards and training your team, you’ll want to establish a system for regular audits and feedback. These audits help you catch any deviations from the rules early and address them promptly. Implementing real-time alerts can be a game-changer, allowing you to respond immediately if certain keywords or risky behaviors are detected.

Now, let’s talk about what happens when you put these mechanisms into action. In the world of financial services, the stakes are high. Your firm’s reputation, legal standing, and client trust hinge on flawless compliance. By rigorously applying your social media compliance framework, you can avoid hefty fines and damaging headlines that often follow regulatory breaches.

Moreover, a well-executed compliance strategy not only protects, but it also enhances your company’s reputation. Clients and investors feel more secure knowing they’re dealing with a firm that takes regulatory responsibilities seriously, fostering a climate of trust and reliability.

To sum up, by creating a clear, enforceable compliance framework and leveraging the right tools for monitoring and audits, you can effectively manage the risks associated with social media in financial services. This approach ensures that your firm not only complies with regulations but also builds a foundation of trust with your clients.

Future Outlook

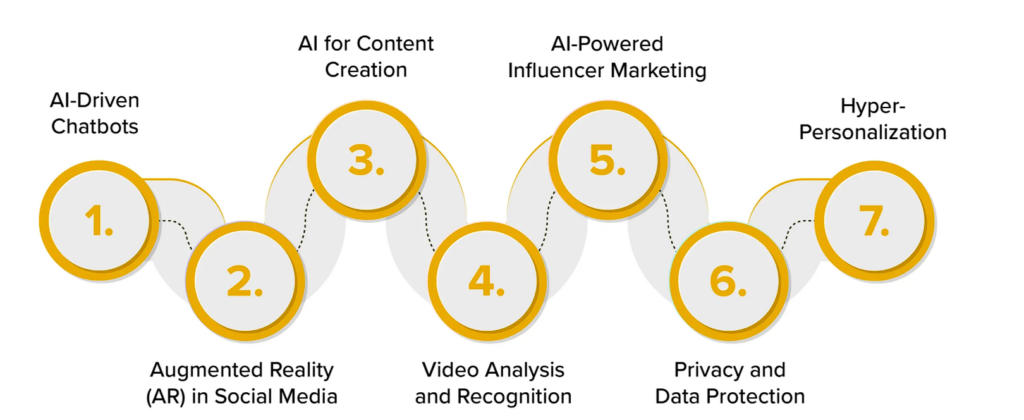

As you look ahead in ensuring social media compliance for financial services, it’s important to consider how emerging trends in regulatory technology (RegTech) will shape your strategies. RegTech tools are becoming increasingly sophisticated, harnessing AI and machine learning to not only monitor but also predict potential compliance issues before they escalate. This means you can anticipate problems and address them proactively, keeping your firm one step ahead in compliance management.

Looking at predictions for social media compliance, expect tighter regulations as financial services become more intertwined with digital platforms. Your approach will likely need to adapt to a landscape where real-time monitoring and instant responses become the norm. Technologies that can analyze large volumes of data quickly to flag non-compliance will become invaluable.

For your firm, staying updated with these advancements and integrating them into your compliance strategies is not just beneficial; it’s essential. This proactive stance ensures that you not only meet current regulatory demands but are also well-prepared for future changes. By embracing these cutting-edge tools, you can enhance your ability to safeguard your operations and maintain trust with clients, regulators, and the public.

Safeguarding Your Digital Presence

Ensuring social media compliance in financial services is essential to maintaining your brand’s integrity and adhering to regulatory standards. In this digital era, your online presence must not only be vibrant but also compliant.

At Flying V, we’re here to guide you through the maze of regulations with a team of experts from around the globe. Our dedicated, remote team works tirelessly to ensure your marketing strategies are both innovative and compliant. Partner with us and supercharge your digital journey.

FAQs

What Are the Primary Regulations Governing Social Media Use in Financial Services?

The primary regulations include FINRA guidelines, SEC rules, and specific national laws that dictate advertising standards, privacy, and record-keeping requirements for communications.

How Can Financial Institutions Monitor Employees’ Social Media Activity for Compliance?

Financial institutions can use specialized compliance software to monitor and archive employees’ social media activity, ensuring it adheres to regulatory standards and internal policies.

What Are the Consequences of Failing to Comply With Social Media Regulations?

Non-compliance can lead to severe penalties including fines, legal actions, and reputational damage, impacting a firm’s credibility and operational standing.

How Often Should a Financial Services Firm Update Its Social Media Compliance Policy?

A firm should review and update its social media compliance policy at least annually or as new regulations and technologies emerge.

What Role Does Technology Play in Ensuring Compliance With Social Media Policies?

Technology facilitates compliance by providing tools for real-time monitoring, archiving communications, and detecting potential breaches, helping firms stay aligned with regulations.

0 Comments