Facebook ads metrics are more than just numbers; they are very relevant in helping the business through the digital marketing terrain of your financial services.

In an era where online visibility reigns supreme, the power to understand the nuances of Facebook ad metrics is in your hands, and our team at Flying V Group will empower you to navigate the digital marketing terrain of financial services confidently.

These metrics define the success of our marketing endeavors and illuminate the path toward optimizing returns.

As we delve into the world of Facebook ads metrics, we uncover their pivotal role in shaping our marketing strategy.

Embark on this journey with us as we collectively explore the significance of measuring ROI in Facebook advertising, charting our course toward marketing success in financial services.

- Overview of Key Metrics

- 2. Cost per Click (CPC)

- 3. Conversion Rate

- 4. Cost per Conversion (CPC)

- 5. Return on Ad Spend (ROAS)

- Application of Metrics in Financial Services

- Challenges and Limitations

- Strategies for Improvement

- Get Invaluable Insights For Your Ad Campaigns

- FAQs

- 1. What challenges do financial services face in accurately tracking attribution for Facebook ad campaigns?

- 2. How can dynamic ads and personalized messaging be utilized effectively in financial services marketing on Facebook?

- 3. How can financial services address ad fatigue and audience saturation on Facebook?

- 4. Are any regulatory concerns or compliance issues specific to financial services advertising on Facebook?

- 5. What are the best practices for targeting and audience segmentation in financial services Facebook ad campaigns?

Overview of Key Metrics

1. Click-Through Rate (CTR)

The click-through rate (CTR) is your digital high-five. It is the percentage of people who click on your ad after seeing it. Think of it as a gauge of how engaging your ad is. The higher the CTR, the better your ad resonates with your audience.

Now, how do you calculate it? It’s simple math: divide the number of clicks by the number of times your ad was shown, then multiply by 100 to get the percentage.

So, when you see a high CTR, pat yourself on the back because it means your ad is grabbing attention and driving action.

2. Cost per Click (CPC)

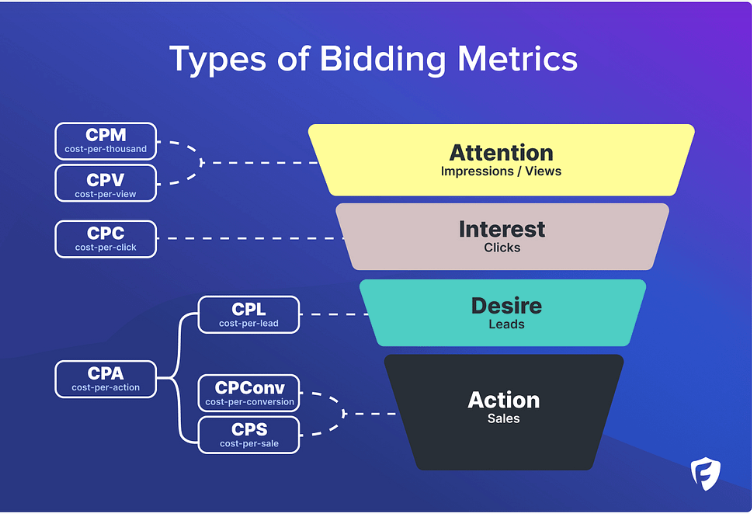

CPC is the amount you pay each time someone clicks on your ad. Think of it as your ad’s ticket price—how much it costs to bring someone to your digital doorstep. Why does it matter?

Because it directly impacts your budget and, ultimately, your ROI. If you’re paying a hefty sum for each click, you better ensure those clicks turn into valuable leads or conversions.

Calculating CPC is a breeze: just divide the total cost of your ad campaign by the number of clicks it generated. The implications? A lower CPC means you’re getting more bang for your buck, while a higher CPC requires tweaking your targeting or ad creative to optimize your spending and maximize returns.

3. Conversion Rate

Let’s talk about Conversion Rate, a real MVP for evaluating marketing ROI in financial services through Facebook ads.

So, what’s the scoop on the Conversion Rate? It’s the superhero of metrics—it tells you the percentage of people who took a desired action after clicking on your ad, whether signing up for a newsletter, filling out a form, or purchasing.

Now, why does it matter? Well, it’s the ultimate litmus test for your campaign effectiveness. A high conversion rate means your ad is hitting the mark and inspiring action, while a low rate might signal that something needs tweaking, whether it’s your offer, targeting, or ad messaging.

So, keep your eyes on that conversion rate—it’s the golden ticket to unlocking marketing success in the financial services realm on Facebook.

4. Cost per Conversion (CPC)

CPC is the price tag attached to each conversion—how much it costs to acquire a lead, make a sale, or achieve whatever action you aim for with your ad campaign. Think of it as the bottom line of your marketing spend, showing you the actual cost of getting results.

Calculating CPC is a breeze: just divide the total cost of your campaign by the number of conversions it generated.

Now, interpreting CPC is where the magic happens. A lower CPC means you’re getting more bang for your buck, while a higher CPC might prompt a closer look at your targeting, ad creative, or offer to ensure you’re getting the most value from your investment.

So, keep your eyes peeled on that CPC—it’s your ticket to optimizing marketing ROI in the financial services arena on Facebook.

5. Return on Ad Spend (ROAS)

Return on Ad Spend (ROAS) is a real game-changer in evaluating marketing ROI in financial services through Facebook ads.

Why is ROAS such a big deal? Well, it’s like your financial compass, guiding you toward the best bang for your buck in your ad campaigns. In finance, every penny counts, and ROAS helps you see exactly how many pennies you’re getting back for every dollar you spend on ads.

Calculating ROAS is straightforward: divide the revenue generated from your ads by the total cost of your ad spend. Now, analyzing ROAS is where the magic happens. A high ROAS means you’re getting more revenue for every dollar spent on ads, indicating a healthy return on investment.

Conversely, a low ROAS might signal that it’s time to reassess your ad strategy or optimize your targeting to maximize returns. So, keep your eyes on that ROAS—it’s the secret sauce to unlocking marketing success in the financial services world on Facebook.

Application of Metrics in Financial Services

Here, real success stories unfold through Facebook ad campaigns. Take, for instance, a leading bank’s campaign targeting millennials for a new credit card offering.

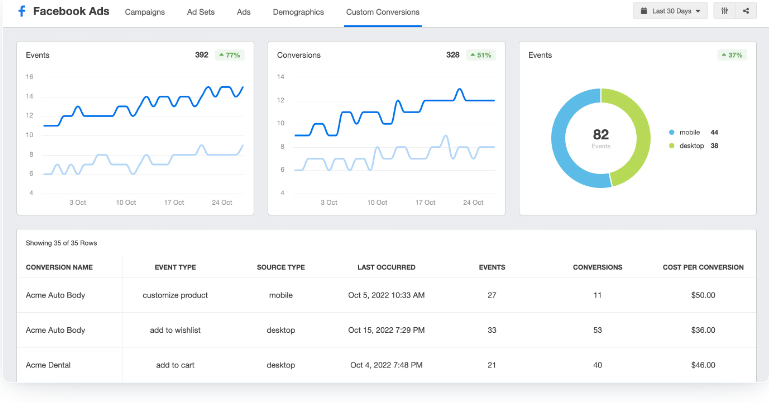

By meticulously tracking Click-Through Rate (CTR), Cost per Click (CPC), Conversion Rate, and Return on Ad Spend (ROAS), they optimized their ads to resonate with the audience, resulting in a significant uptick in credit card applications.

Through this analysis, they uncovered the most effective ad creatives, messaging, and targeting strategies, showcasing how these metrics were instrumental in measuring ROI.

Lessons learned from such campaigns underscore the importance of continuous testing, refining, and adapting strategies to the ever-evolving landscape of Facebook advertising in financial services.

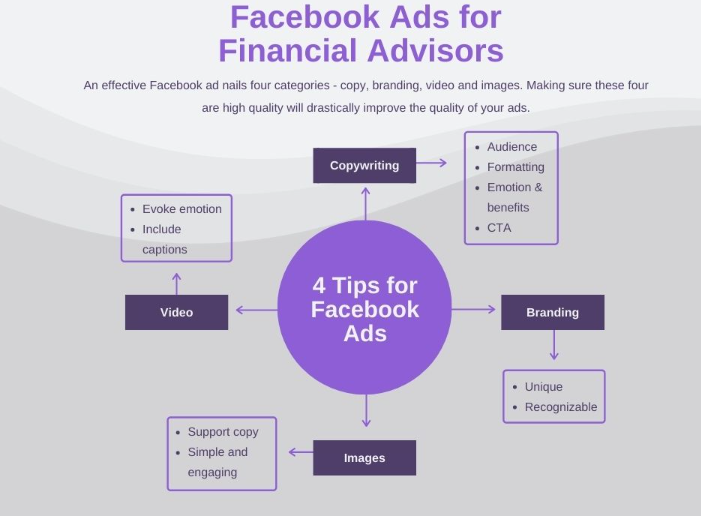

Best practices include leveraging dynamic ads, personalized messaging, and robust audience segmentation to maximize ROI and drive tangible business outcomes.

Challenges and Limitations

Facebook ads metrics in financial services have their fair share of challenges and limitations. They include

- First and foremost, data privacy and regulatory concerns loom large, particularly in an industry as tightly regulated as financial services.

- Striking a delicate balance between effective targeting and compliance with strict regulations is paramount to avoid potential legal repercussions.

- Attribution challenges and tracking accuracy pose another hurdle, as accurately attributing conversions to specific ad campaigns amidst a multi-touchpoint customer journey remains a complex task.

- Furthermore, addressing issues of ad fatigue and audience saturation is essential to prevent diminishing returns and maintain the effectiveness of ad campaigns over time.

- Constantly refreshing ad creative, adjusting frequency caps, and diversifying targeting strategies are crucial to combat audience fatigue and ensure sustained engagement and ROI in the competitive landscape of financial services advertising on Facebook.

Strategies for Improvement

Strategic improvements are essential to enhance marketing ROI in financial services through Facebook ads.

- Leveraging advanced targeting options allows companies to precisely reach their desired audience segments, optimizing ad spend and maximizing conversion potential.

- A/B testing and experimentation enable businesses to refine ad creatives, messaging, and targeting strategies based on real-time data, ensuring continuous improvement and adaptation to evolving consumer preferences.

- Implementing retargeting and remarketing strategies ensures that no potential lead slips through the cracks, engaging with users who have previously interacted with the brand but have yet to convert.

- Additionally, incorporating dynamic ads and personalized messaging enhances user engagement by delivering relevant content tailored to individual preferences and behaviors, fostering stronger connections and driving higher conversion rates in the competitive landscape of financial services marketing on Facebook.

Get Invaluable Insights For Your Ad Campaigns

In wrapping up our exploration of Facebook ads metrics in evaluating marketing ROI, it’s clear that these metrics are more than just numbers—they’re the compass guiding us toward success in digital marketing.

We’ve seen how metrics like Click-Through Rate (CTR), Cost per Click (CPC), Conversion Rate, Cost per Conversion (CPC), and Return on Ad Spend (ROAS) provide invaluable insights into the effectiveness of our ad campaigns.

By understanding and leveraging these metrics, Flying V Group can help you optimize our Facebook ad campaigns to reach the right audience, deliver compelling messaging, and drive meaningful results.

With Flying V Group, you will stay updated with the latest processes in digital marketing for financial services on Facebook and help you exploit these opportunities. Emerging trends such as AI-powered targeting, immersive ad formats, and enhanced data analytics are poised to revolutionize how we engage with our audience and deliver value.

As Flying V Group continues to grow and adapt, armed with a deep understanding of Facebook ads metrics, we’re well-positioned to stay ahead of the curve and solidify our reputation as a trustworthy and influential force in the finance industry.

FAQs

1. What challenges do financial services face in accurately tracking attribution for Facebook ad campaigns?

The complex customer journey in financial decision-making often involves multiple touchpoints across various channels, making it challenging to attribute conversions solely to Facebook ads. Another challenge is the stringent regulatory environment in the financial industry, which may limit data tracking and sharing, hindering comprehensive attribution analysis.

2. How can dynamic ads and personalized messaging be utilized effectively in financial services marketing on Facebook?

Dynamic ads and personalized messaging can enhance Facebook’s financial services marketing by tailoring content to individual preferences and behaviors. By dynamically updating ad content based on user interactions and preferences and delivering personalized messages, financial institutions can engage with prospects more relevant and compellingly, driving higher conversion rates.

3. How can financial services address ad fatigue and audience saturation on Facebook?

Financial services can combat ad fatigue and audience saturation by diversifying ad creatives and messaging, refreshing content regularly, and implementing frequency caps to limit the number of times an ad is shown to the same audience. Additionally, segmenting audiences and targeting niche groups can prevent oversaturation and maintain engagement.

4. Are any regulatory concerns or compliance issues specific to financial services advertising on Facebook?

Regulatory concerns in financial services advertising on Facebook include compliance with laws like the SEC’s advertising rules and regulations governing financial products. Advertisers must ensure transparency, accuracy, and compliance with financial regulations to avoid penalties and maintain trust with customers.

5. What are the best practices for targeting and audience segmentation in financial services Facebook ad campaigns?

Best practices for targeting and audience segmentation in financial services Facebook ad campaigns involve leveraging Facebook’s advanced targeting options to reach specific demographics, interests, and behaviors relevant to financial products. Segmentation based on life events, economic behavior, and income levels can enhance ad relevance and effectiveness.

0 Comments