Social media for financial services isn’t just a trend; it’s a pivotal part of modern business strategy.

In finance, platforms like LinkedIn, Twitter, and Facebook have transitioned from mere communication channels to essential customer engagement and brand-building tools.

This transformation has allowed financial institutions to reach a wider audience and interact with them more personally and immediately.

Whether sharing market insights through timely posts or responding directly to customer queries, social media has reshaped the landscape of financial marketing.

This dynamic shift enhances visibility and strengthens client trust and loyalty, proving that social media can be a powerful ally in the competitive financial sector when handled correctly.

- The Power of Social Media in Finance

- Key Social Media Platforms for Financial Services

- Strategies for Engagement on Social Media

- Compliance and Ethical Considerations

- How to define and measure success in social media for financial services.

- The Future Trends in Social Media Usage Within Financial Services.

- Take Advantage of Social Media For Your Business!

- FAQs

- 1. What are the best social media platforms for financial services?

- 2. How can financial services build trust on social media?

- 3. What type of content works best for financial services on social media?

- 4. How should financial services handle regulations on social media?

- 5. What are effective engagement strategies on social media for financial services?

The Power of Social Media in Finance

Social media wields transformative power for financial institutions, offering unique advantages that can reshape their market presence. This digital arena facilitates direct communication with consumers, allowing for real-time interaction and feedback that traditional media simply cannot match.

Financial services can humanize their brand by engaging directly with customers through social platforms, breaking down the corporate facade, and building personal connections that foster loyalty and trust.

Additionally, these platforms serve as a stage for financial institutions to demonstrate thought leadership and expertise. Through regular updates on market trends, insightful analysis, and educational content, they not only enhance their visibility but also establish themselves as credible, reliable sources in the finance industry.

Moreover, social media’s reach and efficiency in disseminating information make it an invaluable tool for brand visibility.

Financial brands can significantly expand their audience by strategically using targeted ads, sponsored content, and viral marketing campaigns.

The ability to tailor content to specific demographics also enhances engagement rates, ensuring that the message is seen by those most likely to be interested. In sum, social media is not just a communication tool but a strategic asset that, when leveraged correctly, can amplify visibility and strengthen consumer trust in financial services.

Key Social Media Platforms for Financial Services

In the financial sector, specific social media platforms stand out for their effectiveness in reaching and engaging target audiences.

LinkedIn, for instance, is a powerhouse for B2B communication and professional networking, making it an essential platform for financial services looking to connect with industry professionals and corporate clients. Content on LinkedIn often includes in-depth articles, white papers, and company updates that appeal to a professional audience seeking industry insights and thought leadership.

Twitter, on the other hand, excels in real-time communication. Its fast-paced nature is ideal for sharing market updates, quick tips, and participating in relevant financial discussions with hashtags that can increase visibility.

Facebook provides a broader platform suitable for reaching a diverse consumer base. Here, businesses can use video content, infographics, and customer testimonials effectively to engage a more general audience, educating them about financial products and services in a more accessible manner.

Each platform requires a tailored approach: LinkedIn thrives on professional and detailed content, Twitter benefits from quick, engaging posts linked to current events, and Facebook works well with storytelling and visual content.

Understanding these nuances and crafting platform-specific strategies can significantly enhance the effectiveness of social media campaigns in the financial sector, driving engagement and building a solid online presence.

Strategies for Engagement on Social Media

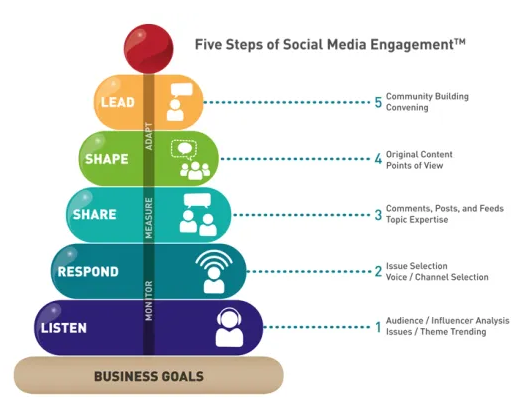

Engaging with customers on social media isn’t just about posting regularly—it’s about sparking conversations and building relationships. Trust and credibility are paramount in financial services; engaging can make all the difference.

One of the best practices is to create content that resonates with your audience’s needs and interests. This could mean developing informative videos that simplify complex financial concepts or offering tips catering to everyday needs.

Another engaging approach is hosting live Q&As or webinars. These provide real-time interaction and position your firm as a helpful and accessible expert in the financial field.

Interactive content like polls, quizzes, and infographics can also drive engagement by inviting the audience to participate actively rather than passively consuming content.

For example, a quiz on investment strategies can engage users and educate them about their personal finance management. It’s crucial to monitor responses and interact promptly—acknowledge comments, answer inquiries, and thank users for their input.

This active engagement helps humanize your brand and fosters a stronger connection with your audience, turning casual followers into loyal customers and advocates for your brand.

Compliance and Ethical Considerations

Navigating the regulatory landscape of social media within the financial services sector requires a keen understanding of compliance and ethical considerations. Financial institutions must adhere to strict guidelines set by regulatory bodies like the SEC and FINRA, ensuring that all communications are transparent and non-misleading.

This includes providing clear disclaimers when necessary, avoiding promoting unsubstantiated claims, and always acting in customers’ best interest. Additionally, maintaining customer privacy is paramount. While engaging on social platforms, never disclosing any personal customer information is crucial. Instead, focus on general advice and direct specific inquiries to more secure communication channels.

Financial services should have robust social media policies and training programs to stay compliant. These policies should outline acceptable practices and content standards to vet every post for compliance risks.

Furthermore, employing dedicated compliance officers to oversee social media interactions can help prevent potential legal issues.

Financial institutions can leverage social media effectively by prioritizing transparency and ethical behavior while building trust and maintaining a solid consumer reputation. This approach not only meets legal requirements but also reassures clients that their financial service providers are committed to upholding high standards of integrity.

How to define and measure success in social media for financial services.

Measuring success in social media for financial services isn’t just about tallying likes and shares; it’s about understanding deeper engagement and how it translates into business outcomes.

To gauge the effectiveness of your social media efforts, you’ll focus on specific key performance indicators (KPIs) that align with your business goals.

These KPIs could include engagement rates (likes, comments, shares), click-through rates to your website, conversion rates (such as sign-ups for a webinar or downloads of a financial planning guide), and the growth of your follower base with a target audience.

To examine these metrics more deeply, use analytics tools provided by social media platforms or specialized third-party services.

These tools can offer insights into how many people interact with your content and how these interactions contribute to your overall business objectives. For example, tracking conversion rates through social media can show how effectively your posts generate leads or close sales.

Furthermore, sentiment analysis can help you understand the emotional tone of the comments and feedback, providing qualitative data that measures public perception and trust in your brand. Regularly analyzing these indicators can refine your strategies, improve engagement, and drive more value from your social media activities.

The Future Trends in Social Media Usage Within Financial Services.

As we look toward the future of social media in financial services, several emerging trends and technologies are set to redefine how financial institutions engage with their customers. Artificial intelligence (AI) and machine learning (ML) are at the forefront, offering sophisticated tools to personalize user experiences at scale.

These technologies will enable financial brands to analyze customer data and social media interactions more efficiently, leading to more targeted and relevant content.

For instance, AI can help tailor financial advice based on individual user behaviors observed on social platforms or predict the best times to post content for optimal engagement.

Additionally, integrating chatbots and AI-driven virtual assistants on social media platforms will enhance customer service and support. These assistants will provide real-time, personalized responses to customer inquiries, improving efficiency and boosting customer satisfaction by offering swift and accurate assistance.

Moreover, we can anticipate a surge in using augmented reality (AR) and virtual reality (VR) in social media campaigns to provide more immersive experiences.

Whether virtual tours of future real estate investments or interactive simulations of financial portfolios, these technologies will make financial concepts easier to understand and more engaging, enhancing customer education and engagement through innovative social media interactions.

Take Advantage of Social Media For Your Business!

In conclusion, the strategic use of social media in the financial services sector is more crucial than ever.

Embracing platforms like LinkedIn, Twitter, and Facebook allows financial institutions to enhance visibility, build meaningful customer relationships, and bolster trust. With the right approach to engaging content, compliance adherence, and cutting-edge technologies like AI, the potential to drive business growth is significant.

Consider partnering with us at Flying V Group to elevate your social media game. Their expertise can help you navigate this complex landscape and ensure your social media efforts are as effective and impactful as possible.

FAQs

1. What are the best social media platforms for financial services?

LinkedIn is ideal for B2B, Twitter for real-time updates, and Facebook for broad consumer engagement.

2. How can financial services build trust on social media?

Share informative content, engage openly, and respond quickly to inquiries and feedback.

3. What type of content works best for financial services on social media?

Educational videos, infographics, real-time market updates, and customer testimonials are very effective.

4. How should financial services handle regulations on social media?

Always comply with industry regulations, prioritize transparency, and secure customer data.

5. What are effective engagement strategies on social media for financial services?

Host live Q&As, create interactive polls, and produce webinars to educate and engage audiences directly.

0 Comments